Category: Uncategorized

The Constitution = Indenture Agreement

Everything else is contract

What is an amendment?

An amendment to the Constitution is an improvement, a correction or a revision to the original content approved in 1788. To date, 27 Amendments have been approved, six have been disapproved and thousands have been discussed.

How is the Constitution amended?

Article V of the Constitution prescribes how an amendment can become a part of the Constitution. While there are two ways, only one has ever been used. All 27 Amendments have been ratified after two-thirds of the House and Senate approve of the proposal and send it to the states for a vote. Then, three-fourths of the states must affirm the proposed Amendment.

The other method of passing an amendment requires a Constitutional Convention to be called by two-thirds of the legislatures of the States. That Convention can propose as many amendments as it deems necessary. Those amendments must be approved by three-fourths of the states.The actual wording of Article V is: “The Congress, whenever two thirds of both Houses shall deem it necessary, shall propose Amendments to this Constitution, or, on the Application of the Legislatures of two thirds of the several States, shall call a Convention for proposing Amendments, which, in either Case, shall be valid to all Intents and Purposes, as part of this Constitution, when ratified by the Legislatures of three fourths of the several States, or by Conventions in three fourths thereof, as the one or the other Mode of Ratification may be proposed by the Congress; Provided that no Amendment which may be made prior to the Year One thousand eight hundred and eight shall in any Manner affect the first and fourth Clauses in the Ninth Section of the first Article; and that no State, without its Consent, shall be deprived of its equal Suffrage in the Senate.”

http://lexisnexis.com/constitution/amendments_howitsdone.asp

U.C.C. – ARTICLE 3 – NEGOTIABLE INSTRUMENTS (2002)

https://www.law.cornell.edu/ucc/3

https://www.law.cornell.edu/ucc/3/3-401

§ 3-401. SIGNATURE.

(a) A person is not liable on an instrument unless (i) the person signed the instrument, or (ii) the person is represented by an agent or representative who signed the instrument and the signature is binding on the represented person under Section 3-402.

(b) A signature may be made (i) manually or by means of a device or machine, and (ii) by the use of any name, including a trade or assumed name, or by a word, mark, or symbol executed or adopted by a person with present intention to authenticate a writing.‹ PART 4. LIABILITY OF PARTIESup§ 3-402. SIGNATURE BY REPRESENTATIVE. ›

Country

Business Organizations with Tax Planning

Publisher: Matthew Bender Elite Productions

16-volume treatise covers the formation and operation of the various types of business entities.

sentiment

- n.A thought, view, or attitude, especially one based mainly on emotion instead of reason: synonym: view.

- n.Emotion; feeling.

deism

Deism is the philosophical position that rejects revelation as a source of religious knowledge and asserts that reason and observation of the natural world are sufficient to establish the existence of a Supreme Being or creator of the universe

asset currency

currency secured exclusively by the general assets of the issuing bank as distinguished from that secured by special deposits (as of government bonds or commercial paper)

salient = obvious

meaning “pointing outward

- adj.Strikingly conspicuous; prominent. synonym: noticeable.

- adj.Projecting or jutting beyond a line or surface; protruding.

- adj.Springing; jumping.

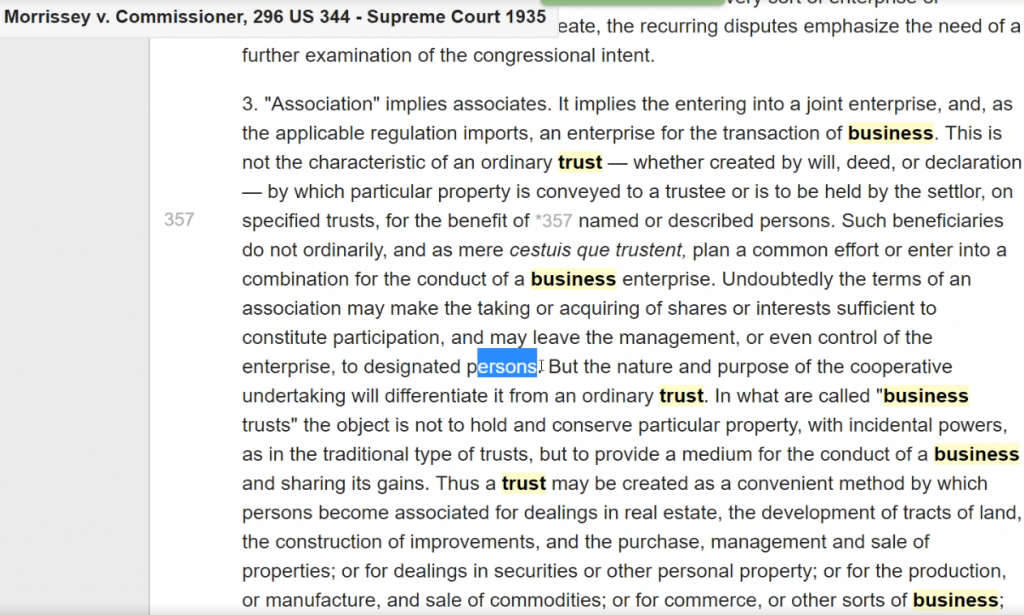

Morrissey v. Commissioner, 296 U.S. 344 (1935)

https://supreme.justia.com/cases/federal/us/296/344/

The term embraces associations as they may exist at common law. Hecht v. Malley, supra. We have already referred to the definitions, quoted in that case, showing the ordinary meaning of the term as applicable to a body of persons united without a charter “but upon the methods and forms used by incorporated bodies for the prosecution of some common enterprise.” These definitions, while helpful, are not to be pressed so far as to make mere formal procedure a controlling test. The provision itself negatives such a construction. Thus, unincorporated joint-stock companies have generally been regarded as bearing the closest resemblance to corporations. But, in the Revenue Acts, associations are mentioned separately, and are not to be treated as limited to “joint-stock companies,” although belonging to the same group. While the use of corporate forms may furnish persuasive evidence of the existence of an association, the absence of particular forms, or of the usual terminology of corporations, cannot be regarded as decisive. Thus, an association may not have “directors” or “officers,” but the “trustees” may function “in much the same manner as the directors in a corporation” for the purpose of carrying on the enterprise. The regulatory provisions of the trust instrument may take the place of “bylaws.” And, as there may be, under the reasoning in the Hecht case, an absence of control by beneficiaries such as is commonly exercised by stockholders in a business corporation, it cannot be considered to be essential to the existence of an association that those beneficially interested should hold meetings or elect their representatives. Again, while the faculty of transferring the interests of members without affecting the continuity of the enterprise may be deemed to be characteristic, the test of an association is not to be found in the mere formal evidence of interests or in a particular method of transfer.