Gross Domestic Product is the market value of all finished goods and services produced within a country in a year

Author: iamking

SPC is about

UCC 3-302, 3-305 3-306

Compelling-State-Interest-Test Law and Legal Definition

Compelling-state-interest-test refers to a method of determining the constitutional validity of a law. Under this test, the government’s interest is balanced against the individual’s constitutional right to be free of law. However, a law will be upheld only if the government’s interest is strong enough.

In Howe v. Brown, 319 F. Supp. 862 (N.D. Ohio 1970), it was held that, the compelling-state-interest-test is mostly applied in all voting rights cases and equal protection cases. It is also applied when a disputed law requires strict scrutiny.

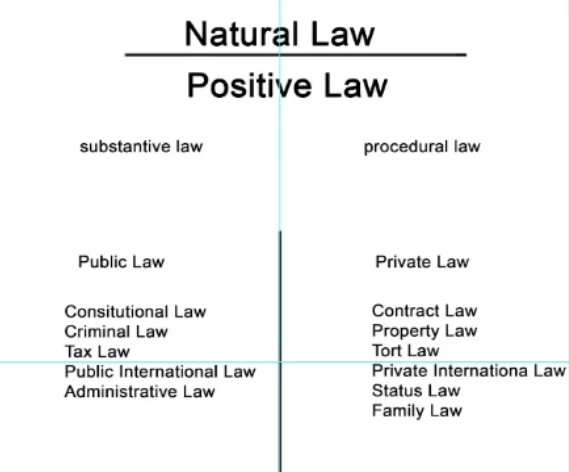

Natural v. Positive Law

Act = Statute

Corporation Tax Act of 1909

Certiorari

In law, certiorari is a court process to seek judicial review of a decision of a lower court or government agency. Certiorari comes from the name of an English prerogative writ, issued by a superior court to direct that the record of the lower court be sent to the superior court for review

article 1 section 8 clause 17

Article I

- Clause 17

- To exercise exclusive Legislation in all Cases whatsoever, over such District (not exceeding ten Miles square) as may, by Cession of particular States, and the Acceptance of Congress, become the Seat of Government of the United States, and to exercise like Authority over all Places purchased by the Consent of the Legislature of the State in which the Same shall be, for the Erection of Forts, Magazines, Arsenals, dock-Yards, and other needful Buildings;–And

https://www.law.cornell.edu/constitution-conan/article-1/section-8/clause-17

26 U.S. Code § 856 – Definition of real estate investment trust

(a)In general

For purposes of this title, the term “real estate investment trust” means a corporation, trust, or association—

(1)which is managed by one or more trustees or directors;

(2)the beneficial ownership of which is evidenced by transferable shares, or by transferable certificates of beneficial interest;

(3)which (but for the provisions of this part) would be taxable as a domestic corporation;

(4)which is neither (A) a financial institution referred to in section 582(c)(2), nor (B) an insurance company to which subchapter L applies;

(5)the beneficial ownership of which is held by 100 or more persons;

(6)subject to the provisions of subsection (k), which is not closely held (as determined under subsection (h)); and

(7)which meets the requirements of subsection (c).

Tax Avoidance = Legal

Tax Evasion = Illegal