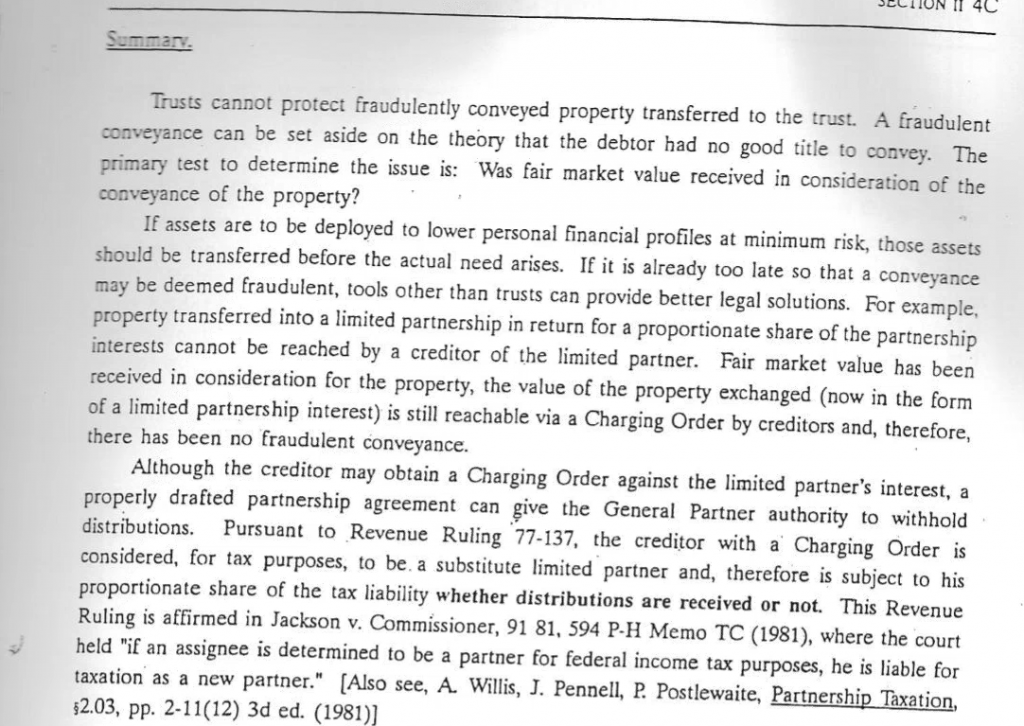

Under U.S. federal tax law, the tax basis of an asset is generally its cost basis. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced basis is referred to as the adjusted tax basis. Adjusted tax basis is used in determining gain or loss from disposition of the asset. Tax basis may be relevant in other tax computations.[1]

https://en.wikipedia.org/wiki/Tax_basis

Tax basis of a member’s interest in a partnership and other flow-through entity is generally increased by the members share of income and reduced by the share of loss. The tax basis of property acquired by gift is generally the basis of the person making the gift. Tax basis in property received from corporations or partnerships may be the corporation’s or partnership’s basis in some cases.