Holding Trust = cars, houses et.al

Family Trust – Business Trust

Holding Trust = cars, houses et.al

Family Trust – Business Trust

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited partner.[1] Limited partnerships are distinct from limited liability partnerships, in which all partners have limited liability.

The GPs are, in all major respects, in the same legal position as partners in a conventional firm: they have management control, share the right to use partnership property, share the profits of the firm in predefined proportions, and have joint and several liability for the debts of the partnership.

As in a general partnership, the GPs have actual authority, as agents of the firm, to bind the partnership in contracts with third parties that are in the ordinary course of the partnership’s business. As with a general partnership, “an act of a general partner which is not apparently for carrying on in the ordinary course the limited partnership’s activities or activities of the kind carried on by the limited partnership binds the limited partnership only if the act was actually authorized by all the other partners.”[2]

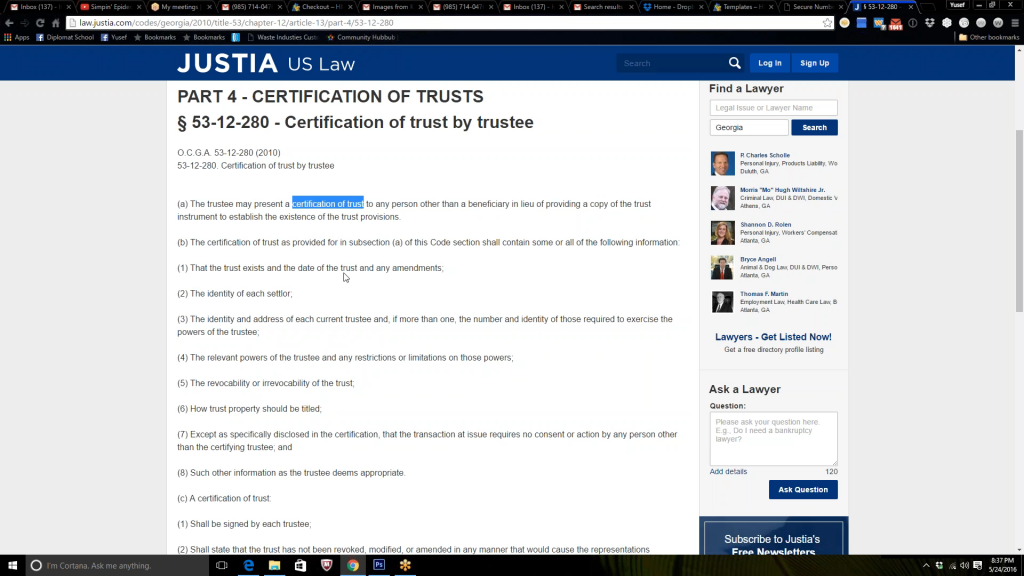

Full-proof is needed. Notary + Authentication

Realestate it is an exchange

Under U.S. federal tax law, the tax basis of an asset is generally its cost basis. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced basis is referred to as the adjusted tax basis. Adjusted tax basis is used in determining gain or loss from disposition of the asset. Tax basis may be relevant in other tax computations.[1]

https://en.wikipedia.org/wiki/Tax_basis

Tax basis of a member’s interest in a partnership and other flow-through entity is generally increased by the members share of income and reduced by the share of loss. The tax basis of property acquired by gift is generally the basis of the person making the gift. Tax basis in property received from corporations or partnerships may be the corporation’s or partnership’s basis in some cases.