https://fitsmallbusiness.com/what-is-a-ucc-filing-lien/

A UCC lien filing, or UCC filing, is a notice lenders file when a business owner takes a loan against an asset. A UCC filing gives lenders a claim on assets a debtor pledges as collateral. The term originates from the Uniform Commercial Code (UCC), a set of rules governing commercial transactions.

Strong borrowers may qualify for business financing even if they have a UCC lien filed against them. For example, ondeck-ucc, which sponsored this article and offers short-term business loans and lines of credit, will take the second position sometimes. Prequalifying online with OnDeck only takes 10 minutes.

When a UCC Filing Occurs

When a business enters a financing agreement that a lender secures with collateral, like equipment, the lender may file a UCC lien against any assets the business pledges to secure the loan. A UCC lien rarely hurts a business’s day-to-day operations but could prevent it from selling assets or getting additional funding.

While other types of liens get filed because of something bad happening, such as not paying taxes, a UCC lien is a normal part of small business financing. The lien serves as a notice to all potential creditors that the borrower owes the lender money and that the lender has an interest in business assets until the business repays the debt.

Where a UCC Filing Comes From

A UCC filing begins when borrowers agree to pledge assets to a lender for a loan or business line of credit by signing a security agreement. A security agreement gives the lender the right to use specific assets as collateral. Once a borrower signs a security agreement, it is normal for a lender to file a UCC lien against the assets a business pledges to give notice of its rights to any other potential lenders.

Lenders can file UCC liens against businesses or individuals. They work on a first-come-first-serve basis, so if there is a default, the first lender to file a UCC lien will have the first rights to that asset. The lender is reserving its spot in line to collect on the assets a business pledges to them.

For example, let’s say Bank A files a UCC lien on equipment, and Bank B files a lien on the same equipment later. Bank A will get first rights to the equipment. If the business is in default and sells the asset to pay off debts, then Bank A will get repaid first. Bank B will only get money after the proceeds repay Bank A.

Lenders can file a UCC lien on assets that include:

- Office equipment

- Receivables

- Inventory

- Investment securities

- Large operating equipment

- Vehicles

- Real estate

- Commercial instruments, such as drafts or promissory notes

- Letters of credit

- Other goods used or owned by the business

UCC liens prevent businesses from getting multiple loans collateralized by the same assets. Before these notices came along, a business owner could get five loans on the same piece of farm equipment because none of the lenders knew about each other. Now anyone can do a public UCC search to determine what assets are available as collateral for a loan application process.

UCC Liens Offer Protection Across State Lines

In many cases, business transactions occur across state or country lines. As an example, companies based in New York sell products or services to businesses in California or other states. Every state has its own commercial transaction laws that could complicate the procedures to protest a business during financing transactions.

The UCC protects businesses with operations in different states by creating uniformity in how states deal with these transactions. UCC liens are a way for businesses to keep their financial interests when financing equipment, real estate, or taking business collateral for loans.

2 Common Types of UCC Liens

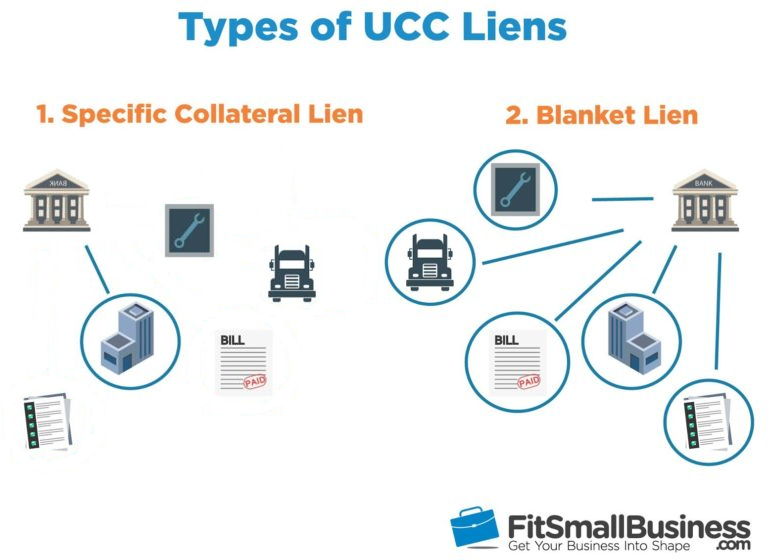

Lenders file a UCC lien when a business owes the lender money, and the lender wants to reserve its spot in line for the assets the business pledges. There are two common types of UCC filings a specific collateral lien and a blanket lien. A specific collateral lien gives the lender rights to a specific business asset like a piece of equipment. A blanket lien gives the lender rights to all business assets.

1. UCC Liens Against Specific Collateral

A UCC filing against specific collateral is when the creditor secures an interest in one or more assets but does not have an interest in all business assets. Borrowers are using specific assets as collateral to secure a loan or credit agreement. Specific collateral liens are most common for loans that have a specific purpose, such as equipment financing and inventory financing.

For example, business owners that finance a semi-truck can expect the lender to file a UCC lien and list the big rig as collateral. However, borrowers wouldn’t need to pledge assets beyond the financed truck.

2. UCC Blanket Liens

A UCC blanket lien occurs when a creditor secures an interest in every asset of a business. When a lender files a blanket lien against all assets, it becomes difficult to get additional funding for the business until it satisfies the lien, or the lender removes it.

Blanket liens are common for traditional bank loans, Small Business Administration (SBA) loans, and alternative business loans. SBA and traditional bank lenders use blanket liens to secure their loans. OnDeck and other alternative lenders use blanket liens when businesses do not have many hard assets for a loan. Using an alternative lender is sometimes the only way to get funding when a business does not have enough assets to satisfy a traditional lender.

All lenders like blanket liens because it secures their loan with all assets instead of one. A blanket lien can make the process of underwriting financing more flexible and allows lenders to provide quicker funding.

“Banks will often require a business to have specific collateral, like real estate, to qualify for a loan. By using a blanket lien and personal guarantee, alternative lenders can help healthy businesses gain access to capital without requiring specific collateral to secure the loan.”

―Ty Kiisel, Editor, ondeck-ucc

Although most online lenders require a blanket lien, they are not the only lenders with the requirement. Inventory financing and invoice financing also require a blanket UCC lien, whereas short-term business loans and merchant cash advances may accept a second or third position in some circumstances.