Month: March 2020

Tachyon

A tachyon (/ˈtækiɒn/) or tachyonic particle is a hypothetical particle that always travels faster than light. Most physicists believe that faster-than-light particles cannot exist because they are not consistent with the known laws of physics.[1][2] If such particles did exist, they could be used to build a tachyonic antitelephone and send signals faster than light, which (according to special relativity) would lead to violations of causality.[2] No experimental evidence for the existence of such particles has been found.

The possibility of particles moving faster than light was first proposed by Robert Ehrlich and Arnold Sommerfeld, independently of each other. In the 1967 paper that coined the term,[3] Gerald Feinberg proposed that tachyonic particles could be quanta of a quantum field with imaginary mass. However, it was soon realized that excitations of such imaginary mass fields do not under any circumstances propagate faster than light,[4] and instead the imaginary mass gives rise to an instability known as tachyon condensation.[1] Nevertheless, in modern physics the term tachyon often refers to imaginary mass fields rather than to faster-than-light particles.[1][5] Such fields have come to play a significant role in modern physics.

The term comes from the Greek: ταχύ, tachy, meaning rapid. The complementary particle types are called luxons (which always move at the speed of light) and bradyons (which always move slower than light); both of these particle types are known to exist.

Ecological pyramid

An ecological pyramid (also trophic pyramid, Eltonian pyramid, energy pyramid, or sometimes food pyramid) is a graphical representation designed to show the biomass or bioproductivity at each trophic level in a given ecosystem.

A pyramid of energy shows how much energy is retained in the form of new biomass at each trophic level, while a pyramid of biomass shows how much biomass (the amount of living or organic matter present in an organism) is present in the organisms. There is also a pyramid of numbers representing the number of individual organisms at each trophic level. Pyramids of energy are normally upright, but other pyramids can be inverted or take other shapes.

Ecological pyramids begin with producers on the bottom (such as plants) and proceed through the various trophic levels (such as herbivores that eat plants, then carnivores that eat flesh, then omnivores that eat both plants and flesh, and so on). The highest level is the top of the food chain.

alliance (n.)

c. 1300, “bond of marriage” (between ruling houses or noble families), from Old French aliance (12c., Modern French alliance) “alliance, bond; marriage, union,” from aliier (Modern French allier) “combine, unite” (see ally (v.)).

General sense of “combination for a common object” is from mid-14c., as are those of “bond or treaty between rulers or nations, contracted by treaty” and “aggregate of persons allied.” Unlike its synonyms, “rarely used of a combination for evil” [Century Dictionary]. Meaning “state of being allied or connected” is from 1670s. The Latin word was alligantia.

treaty (n.)

late 14c., “treatment, discussion,” from Anglo-French treté, Old French traitié “assembly, agreement, dealings,” from Latin tractatus “discussion, handling, management,” from tractare “to handle, manage” (see treat (v.)). Sense of “contract or league between nations or sovereigns” is first recorded early 15c.

federal (adj.)

1640s, as a theological term (in reference to “covenants” between God and man), from French fédéral, an adjective formed from Latin foedus (genitive foederis) “covenant, league, treaty, alliance,” from PIE *bhoid-es-, suffixed form of root *bheidh- “to trust, confide, persuade.”

Secular meaning “pertaining to a covenant or treaty” (1650s) led to political sense of “formed by agreement among independent states” (1707), from use of the word in federal union “union based on a treaty” (popularized during formation of U.S.A. 1776-1787) and like phrases. Also from this period in U.S. history comes the sense “favoring the central government” (1788) and the especial use of the word (as opposed to confederate) to mean a state in which the federal authority is independent of the component parts within its legitimate sphere of action. Used from 1861 in reference to the Northern forces in the American Civil War.

What Is a UCC Filing & How a UCC Lien Works

https://fitsmallbusiness.com/what-is-a-ucc-filing-lien/

A UCC lien filing, or UCC filing, is a notice lenders file when a business owner takes a loan against an asset. A UCC filing gives lenders a claim on assets a debtor pledges as collateral. The term originates from the Uniform Commercial Code (UCC), a set of rules governing commercial transactions.

Strong borrowers may qualify for business financing even if they have a UCC lien filed against them. For example, ondeck-ucc, which sponsored this article and offers short-term business loans and lines of credit, will take the second position sometimes. Prequalifying online with OnDeck only takes 10 minutes.

When a UCC Filing Occurs

When a business enters a financing agreement that a lender secures with collateral, like equipment, the lender may file a UCC lien against any assets the business pledges to secure the loan. A UCC lien rarely hurts a business’s day-to-day operations but could prevent it from selling assets or getting additional funding.

While other types of liens get filed because of something bad happening, such as not paying taxes, a UCC lien is a normal part of small business financing. The lien serves as a notice to all potential creditors that the borrower owes the lender money and that the lender has an interest in business assets until the business repays the debt.

Where a UCC Filing Comes From

A UCC filing begins when borrowers agree to pledge assets to a lender for a loan or business line of credit by signing a security agreement. A security agreement gives the lender the right to use specific assets as collateral. Once a borrower signs a security agreement, it is normal for a lender to file a UCC lien against the assets a business pledges to give notice of its rights to any other potential lenders.

Lenders can file UCC liens against businesses or individuals. They work on a first-come-first-serve basis, so if there is a default, the first lender to file a UCC lien will have the first rights to that asset. The lender is reserving its spot in line to collect on the assets a business pledges to them.

For example, let’s say Bank A files a UCC lien on equipment, and Bank B files a lien on the same equipment later. Bank A will get first rights to the equipment. If the business is in default and sells the asset to pay off debts, then Bank A will get repaid first. Bank B will only get money after the proceeds repay Bank A.

Lenders can file a UCC lien on assets that include:

- Office equipment

- Receivables

- Inventory

- Investment securities

- Large operating equipment

- Vehicles

- Real estate

- Commercial instruments, such as drafts or promissory notes

- Letters of credit

- Other goods used or owned by the business

UCC liens prevent businesses from getting multiple loans collateralized by the same assets. Before these notices came along, a business owner could get five loans on the same piece of farm equipment because none of the lenders knew about each other. Now anyone can do a public UCC search to determine what assets are available as collateral for a loan application process.

UCC Liens Offer Protection Across State Lines

In many cases, business transactions occur across state or country lines. As an example, companies based in New York sell products or services to businesses in California or other states. Every state has its own commercial transaction laws that could complicate the procedures to protest a business during financing transactions.

The UCC protects businesses with operations in different states by creating uniformity in how states deal with these transactions. UCC liens are a way for businesses to keep their financial interests when financing equipment, real estate, or taking business collateral for loans.

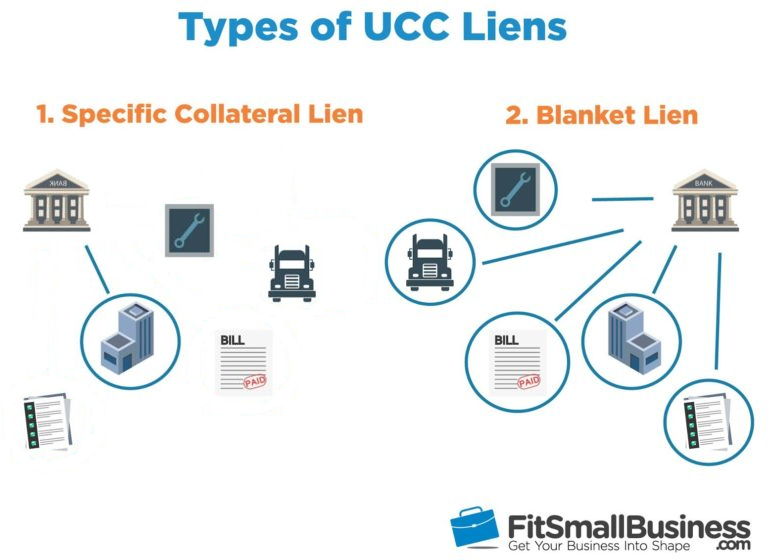

2 Common Types of UCC Liens

Lenders file a UCC lien when a business owes the lender money, and the lender wants to reserve its spot in line for the assets the business pledges. There are two common types of UCC filings a specific collateral lien and a blanket lien. A specific collateral lien gives the lender rights to a specific business asset like a piece of equipment. A blanket lien gives the lender rights to all business assets.

1. UCC Liens Against Specific Collateral

A UCC filing against specific collateral is when the creditor secures an interest in one or more assets but does not have an interest in all business assets. Borrowers are using specific assets as collateral to secure a loan or credit agreement. Specific collateral liens are most common for loans that have a specific purpose, such as equipment financing and inventory financing.

For example, business owners that finance a semi-truck can expect the lender to file a UCC lien and list the big rig as collateral. However, borrowers wouldn’t need to pledge assets beyond the financed truck.

2. UCC Blanket Liens

A UCC blanket lien occurs when a creditor secures an interest in every asset of a business. When a lender files a blanket lien against all assets, it becomes difficult to get additional funding for the business until it satisfies the lien, or the lender removes it.

Blanket liens are common for traditional bank loans, Small Business Administration (SBA) loans, and alternative business loans. SBA and traditional bank lenders use blanket liens to secure their loans. OnDeck and other alternative lenders use blanket liens when businesses do not have many hard assets for a loan. Using an alternative lender is sometimes the only way to get funding when a business does not have enough assets to satisfy a traditional lender.

All lenders like blanket liens because it secures their loan with all assets instead of one. A blanket lien can make the process of underwriting financing more flexible and allows lenders to provide quicker funding.

“Banks will often require a business to have specific collateral, like real estate, to qualify for a loan. By using a blanket lien and personal guarantee, alternative lenders can help healthy businesses gain access to capital without requiring specific collateral to secure the loan.”

―Ty Kiisel, Editor, ondeck-ucc

Although most online lenders require a blanket lien, they are not the only lenders with the requirement. Inventory financing and invoice financing also require a blanket UCC lien, whereas short-term business loans and merchant cash advances may accept a second or third position in some circumstances.

UCC Filings

UCC Filings – The UCC Filings main menu option offers the following options:

Eligible Non-citizen = Indigenous

Article 5: UN Declaration on the Rights of Indigenous Peoples

+

UN Convention on Economic Social and Cultural Rights

(U.S Signed off on Dec. 16, 1966)

Shungite

Shungite is a black, lustrous, non-crystalline mineraloid consisting of more than 98 weight percent of carbon. It was first described from a deposit near Shunga village, in Karelia, Russia, from where it gets its name. Shungite has been reported to contain trace amounts of fullerenes (0.0001 < 0.001%).[1][2]

Contents

Terminology[edit]

The term “shungite” was originally used in 1879 to describe a mineraloid with more than 98 percent carbon. More recently the term has also been used to describe shungite-bearing rocks, leading to some confusion.[3] Shungite-bearing rocks have also been classified purely on their carbon content, with Shungite-1 having a carbon content in the range 98-100 weight percent and Shungite-2, -3, -4 and -5 having contents in the ranges 35-80 percent, 20-35 percent, 10-20 percent and less than 10 percent, respectively.[3] In a further classification, shungite is subdivided into bright, semi-bright, semi-dull and dull on the basis of their luster (the terms lustrous and matte are also used for bright and dull).[4]

Shungite has two main modes of occurrence, disseminated within the host rock and as apparently mobilised material. Migrated shungite, which is bright (lustrous) shungite, has been interpreted to represent migrated hydrocarbons and is found as either layer shungite, layers or lenses near conformable with the host rock layering, or vein shungite, which is found as cross-cutting veins. Shungite may also occur as clasts within younger sedimentary rocks.[3]